The year 2014 was a shocking year for Qantas, reporting a crimpling $2.8 billion loss for the year (Janda 2014).

On a mission to re-emerge into the black, Qantas went through a major overhaul making significant changes to its business to deliver its best calendar year financial result for 2015 in its 95-year history (Cameron 2016).

Qantas has prided themselves on delivering a number of successful marketing campaigns in the past 12 months led by Jo Boundy, Qantas Chief Marketing Officer of Qantas Loyalty. Boundy quotes “so much of marketing, and particularly loyalty marketing, is all based around data…the biggest challenge will be how we make best use of the information we have to deliver the most valuable program we can for our customers” (Clampet 2016).

Boundy is a key member of Qantas senior management, with Mintz and Currim supporting that the employment of a CMO reduces uncertainty that Qantas top management faces in marketing areas (Mintz and Currim, 2013).

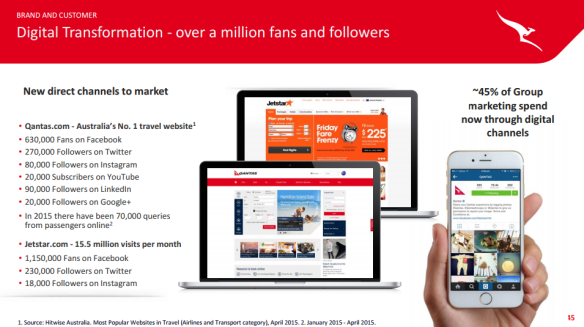

The Qantas Investor day briefing presentation for 2015 included the capture and use of specific marketing metrics for social media, including the number of followers with 630,000 fans of Qantas Facebook page.

Qantas Investor Day 2015 briefing

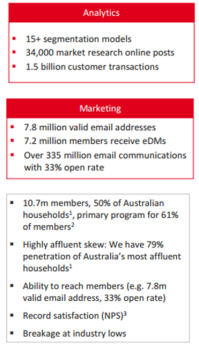

Loyalty program

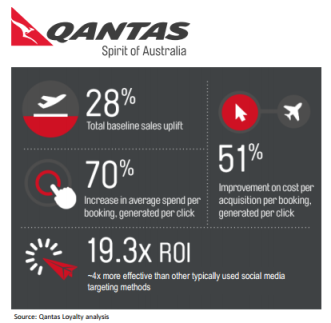

Qantas Loyalty Program metrics

Qantas’ loyalty program has enabled the business to gather valuable behavioural profile metrics for purchase frequency. Qantas also boasts of the marketing efficiencies that have been achieved due to their loyalty program with improved targeting and segmentation, differentiated incentives and insight driven campaigns (Qantas, Investor Day 2015).

Qantas utilise the marketing metric of reach for their loyalty program quoting 10.7 million members representing 50% of Australian households, and the marketing metric of hits to Qantas website, with a reported 2.5 million visits to Qantas.com per week.

Red Planet

Red Planet a new digital marketing business was launched by Qantas which focused on delivering media, analytics and research services.

Red Plant delivering value for Qantas

Red Planet was a success, with Qantas estimating that the marketing delivered a staggering return-on-investment of 19.3, quoting this marketing was 4 times more effective than other typically used social media targeting methods (Qantas, Investor Day 2015).

However one could side with Ambler and Roberts, who argue that the financial metric of return-on-investment has its flaws, becoming a fashionable term that can be used to describe any type of profit arising from marketing activities. With strong support that the fall in the price of airline fuel as a major input costs playing a contributing factor in the increase in underlying profit and not the marketing program (Ambler and Roberts, 2008).

Dashboards

Marketing dashboards are a recent evolution for Qantas, with a Melbourne Business School MBA Student Cuicui Jin developing a marketing dashboard for Qantas as part of an internship. Qantas Brand Strategy Manager Jonathon Thompson quoting “thanks to Cuicui, we have a more effective communication tool to demonstrate the commercial contribution of marketing to the airline. It means our executives are able to have a far more holistic view, and it gives us a really simple tool to showcase our performance across the broader organisation” (Melbourne Business School 2015).

Jonathon’s comments align to the view of Ambler and Roberts, who endorse that a dashboard is essential to help top management drive the business as it facilitates the ability to “bring together the multiple measures seen by senior into a clear, integrated and concise package” (Ambler and Roberts, 2008).

One could see how Qantas could be heavy on utilising marketing metrics as opposed to financial metrics. However this is consistent with the argument that Qantas is a market-oriented business as its top management has a customer-based focus, supported by an interest in assessing customer satisfaction and needs, linking to the relationship between satisfaction and the Qantas brand assets (Mintz and Currim, 2013).

But in a competitive industry, shouldn’t customer-based focus be the strategy? The supporting evidence you ask – well don’t the Qantas 2015 results speak for themselves?

(Markart 2012)

Blog by Annika Bate, wordpress username: annikampk732, student ID: 214448725. email: annikab@deakin.edu.au

Reference List

Ambler, T and Roberts, J 2008, Assessing marketing performance: don’t settle for a silver metric, Journal of Marketing Management. Sep2008, Vol. 24 Issue 7/8, p733-750, Deakin university database

Cameron, N 2016, “Qantas reveals history-making financial results; announces Wi-Fi services”, CMO, retrieved 21 May 2016, < http://www.cmo.com.au/article/594531/qantas-reveals-history-making-financial-results-announces-wi-fi-services/>

Clampet, J 2016 “Skift CMO Interviews: Qantas CMO on Marketing Through Better Loyalty”, Skift, retrieved 20 May 2016, < https://skift.com/2016/04/28/skift-cmo-interviews-qantas-cmo-on-marketing-through-better-loyalty/>

Janda, M 2014, “Qantas shocks with $2.8bn full-year loss, analysts call for management spill” ABC News, retrieved 18 May 2016, < http://www.abc.net.au/news/2014-08-28/qantas-full-year-profit-result/5702266>

Markart 2012, Cartoon gallery, retrieved 21 May 2016, <http://www.markart.com.au/archive.html>

Melbourne Business School, 2015 “Cuicui Jin is flying high at Qantas”, retrieved 20 May 2016, <https://mbs.edu/news/cuicui-jin-flying-high-at-qantas>

Milichovsky, F and Simberova, I 2015, “Marketing Effectiveness: Metrics for Effective Strategic Marketing” Engineering Economics Vol. 26 Issue 2, p211-219. Database: Business Source Complete. Doi: 10.5755/j01.ee.26.2.3826

Mintz, O and Currim, I 2013, What drives managerial use of marketing and financial metrics and does metric use affect performance of marketing mix activities? Journal of Marketing, Volume 77, pp. 17-40, Deakin university database

Qantas, 2015 “Qantas Investor Day”, retrieved 21 May 2016, <https://www.qantas.com.au/infodetail/about/investors/investor-day-presentation-2015.pdf>

diverse group of models intended to represent all consumers. Media recently praised Kmart for the inclusion of

diverse group of models intended to represent all consumers. Media recently praised Kmart for the inclusion of  on

on